|

||||

|

In this update:

Voter ID: Time for PA to Catch Up with Other States, Nations

A proposed constitutional amendment passed by the Senate earlier this month to require ID verification at polling places remains in the House of Representatives. Its approval is needed to let voters have a say through a ballot question in the spring primary election. Pennsylvania’s failure to enact this key component of election integrity has put it behind not only a vast majority of states and most developed countries, but behind many developing nations as well. Every excuse used to block this rational election reform has been shown to be false. Requiring proof of identification before voting does not suppress turnout, and acceptable IDs are not difficult to obtain. Nationally, the calls for voter ID come from Democrats and Republicans alike. Eighty percent of Americans favor voter ID as do 74% of Pennsylvanians. Now is the time to pass Senate Bill 1 and let the voters decide. Restoring Checks and Balances in Pennsylvania Government

In addition to letting citizens decide whether voters should be required to show ID, Senate Bill 1 includes a proposed constitutional amendment allowing the people’s representatives in the General Assembly to overturn any government regulation that conflicts with the will of the people. The need for this change was made clear by the Wolf administration’s unilateral decisions during the pandemic, closing businesses and schools with no input from the people. Despite the clear design of our government with three co-equal parts, the executive branch elevated itself above the legislative and judicial branches in an obvious violation of the checks and balances afforded by the Pennsylvania Constitution. No governor of any party should be permitted to wield such unchecked power again. If the House of Representatives follows the Senate’s lead and passes Senate Bill 1, voters will be empowered to restore this crucial balance of power. Visiting with the Pennsylvania Farm Bureau of Butler County

On Wednesday, I had the opportunity to meet with William Thiele, a state board director for the Pennsylvania Farm Bureau representing Butler County. William and I had a discussion regarding current issues facing our agricultural industry and ongoing burdens that our farmers deal with daily. Thank you, William for stopping by! Phase-out of Job-Killing PA Tax Begins

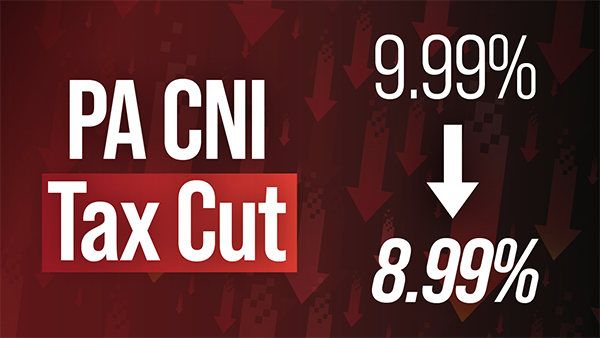

The phase-out of Pennsylvania’s sky-high Corporate Net Income tax got underway this month, part of our efforts to keep good jobs here and create new ones. As chairman of the Senate Finance Committee, I worked with fellow Republican lawmakers to secure a cut in this job-killing tax as part of the 2022-23 state budget. Before this recent reduction to 8.99%, Pennsylvania’s CNI tax had been 9.99% for nearly three decades while most other states had lower tax rates – some far lower – and many have been lower for almost as long. When gradually reduced to 4.99% in 2031, Pennsylvania’s CNI rate will have gone from one of the highest in the nation to one of the lowest, making the commonwealth far more competitive with other states. As Finance Chairman I will continue to press for a more aggressive timeline in reducing this tax, given the demonstrable benefits it provides. A 2009 report by an economist at the Federal Reserve Bank of Kansas City demonstrates that the burden of the corporate income tax is borne in large part by labor within the state in the form of lower wages. A 2016 paper published in the journal American Economic Review found employees shoulder about a third of the corporate tax burden. Reducing this tax even more quickly then currently planned will be the difference between jobs coming to our local communities or jobs going to other states (or countries). Rebates for Property Taxes and Rent Available to Seniors, Pennsylvanians with Disabilities

Older adults and Pennsylvanians with disabilities can apply now for rebates on property taxes or rent paid in 2022. The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Spouses, personal representatives or estates may also file rebate claims on behalf of claimants who lived at least one day in the claim year and meet all other eligibility criteria. The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. You can find more eligibility and application information here. Eligible applicants can visit mypath.pa.gov to electronically submit their applications. Personal Empowerment Training for Butler County Recovery Community Butler County Community College is offering “Personal Empowerment Training for Butler County Recovery Community” beginning Feb. 28 with additional dates in March. Butler County recovery community members are invited to attend this training at no cost. This training will explore over 40 emotional concepts such as beliefs, self-esteem, empathy, active listening and managing conflict. Participants’ increased knowledge, practice and application encourages new perspectives and habits. Space is limited and the registration deadline is Feb. 24. You can find details and registration information here. Lowering the Risk of Birth Defects

Rates of infant deaths due to birth defects have declined by 10% in the United States. However, even today, every 4½ minutes a baby is born with a major problem affecting parts of the body including the heart, brain or foot, causing lifelong health challenges. The National Birth Defects Prevention Network offers women five tips for preventing birth defects:

Not all birth defects can be prevented. However, healthy choices and habits help lower the risk of having a baby born with these challenges. |

||||

|

||||

Want to change how you receive these emails? 2025 © Senate of Pennsylvania | https://www.senatorscotthutchinson.com | Privacy Policy |